Financial planning,insurance and protection

Getting on top of your finances is one of the most important things you can do for yours and your family’s future. Whether you're looking to consolidate your pensions, boost your contributions, invest for the long term, or protect yourself and your loved ones with life or health cover, Parasol Financial Planning can help.

You’ll be matched with a dedicated financial advisor who’ll give you honest, tailored advice so you feel confident about the future and know your money is working and growing as hard as it can. You’ll also find out how to top up your pension by 11.5%+ each month - on top of regular contributions .

Perks

Free consultation

Increase pension contributions by 11.5%+ monthly (if you’re a Parasol employee)

Dedicated financial advisor

Regular reviews at your convenience

How can Parasol Financial Planning help you?

Below are just some of the ways Parasol Financial Planning can help you on your journey.

Pension planning

and 11.5%+ pension top-up

You’ll get personal, tailored advice on pension planning and, if you’re a Parasol employee, how to maximise on our 11.5%+ pension top-up scheme. You’ll gain actionable advice on how to make your money work harder, for longer, while keeping it protected.

Health

insurance

Getting sick is stressful enough without worrying about how fast you'll be seen or how much treatment might cost. Parasol Financial Planning will help you choose the right health insurance provider, so you and your family get the care you need, when you need it.

Income protection & life cover

Only getting paid when you work is one of the hardest parts of contracting. With Parasol Financial Planning, you can be confident you’ve got the right protection in place when it matters most so if sickness or bereavement happens, your income keeps coming in and your family stays financially secure.

Take your free financial healthcheck.

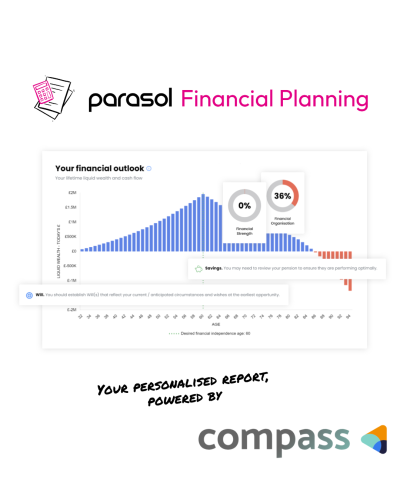

Parasol Financial Planning is offering a free financial health check, giving you a personalised report in just a few minutes.

Powered by Compass - a market-leading technology - your report includes real-time insights on what you’re doing well, where you could improve, and practical tips on areas like...

Savings, investments & pensions

Income & expenditure

Mortgages

Ready to get started?

Take your free health check today to receive your personalised report instantly and review the results with an independent financial advisor.

Financial planning FAQs

Why is pension planning so important?

Pension planning is important simply because the earlier you start, the more money you’ll have when you’re ready to retire. Planning ahead means your pension grows over time through regular contributions and interest so with smart financial planning, your pension will set you and your family up for a happy future.

What is Parasol's 11.5% pension top-up scheme?

As a Parasol employee, we’ll top up your pension by 11.5%+ when you contribute to a private pension provider through us.

How does health insurance and income protection differ?

Health insurance covers medical costs when you become ill and helps you access treatment faster. Income protection however covers your earnings if you can’t work due to things like illness, injury or bereavement - so you still get paid, even when life throws a curveball.

Ultimately, health insurance and income protection work best together, especially if you’re a contractor. There’s a wide range of providers to choose from, each offering varying levels of cover, benefits and price. Parasol Financial Planning will help you weigh up the different options and choose the right one for you and your family.

Ready to take control of your finances?

Book your free consultation with a financial advisor today.

*Parasol Financial Planning is a trading style of Cheetham Jackson Ltd (FRN 514951) who is authorised and regulated by the

Financial Conduct Authority. Cheetham Jackson Ltd is registered in England, Company Registration Number 070714622.

Registered Office: 23 Market Street, Chorley, PR7 2SY