Your trusted partner

in payroll & employment solutions

Calculations are examples based on a series of assumptions

ASSUMPTIONS

GENERAL:

Based on rates and thresholds for 2025/26.

Assumes 12 months worked post 6th April 2025

No income from other sources in the tax year

Working 40 hours per week over 52 weeks

28 days holiday per year

1257L tax code

UMBRELLA

You are not subject to SDC

Includes Parasol umbrella solution margin - £15 average

Holiday pay is paid in advance of taking any annual leave

Pension is not taken into account

No expenses can be claimed.

LIMITED

Assignments are not subject to IR35

Includes flat rate VAT benefit for the first year at 15.5%.

Director's fee of £229 per week

Includes Caroola Accountancy fee of £135 per month

Claiming £265 expenses per week

Claiming 200 business miles per week

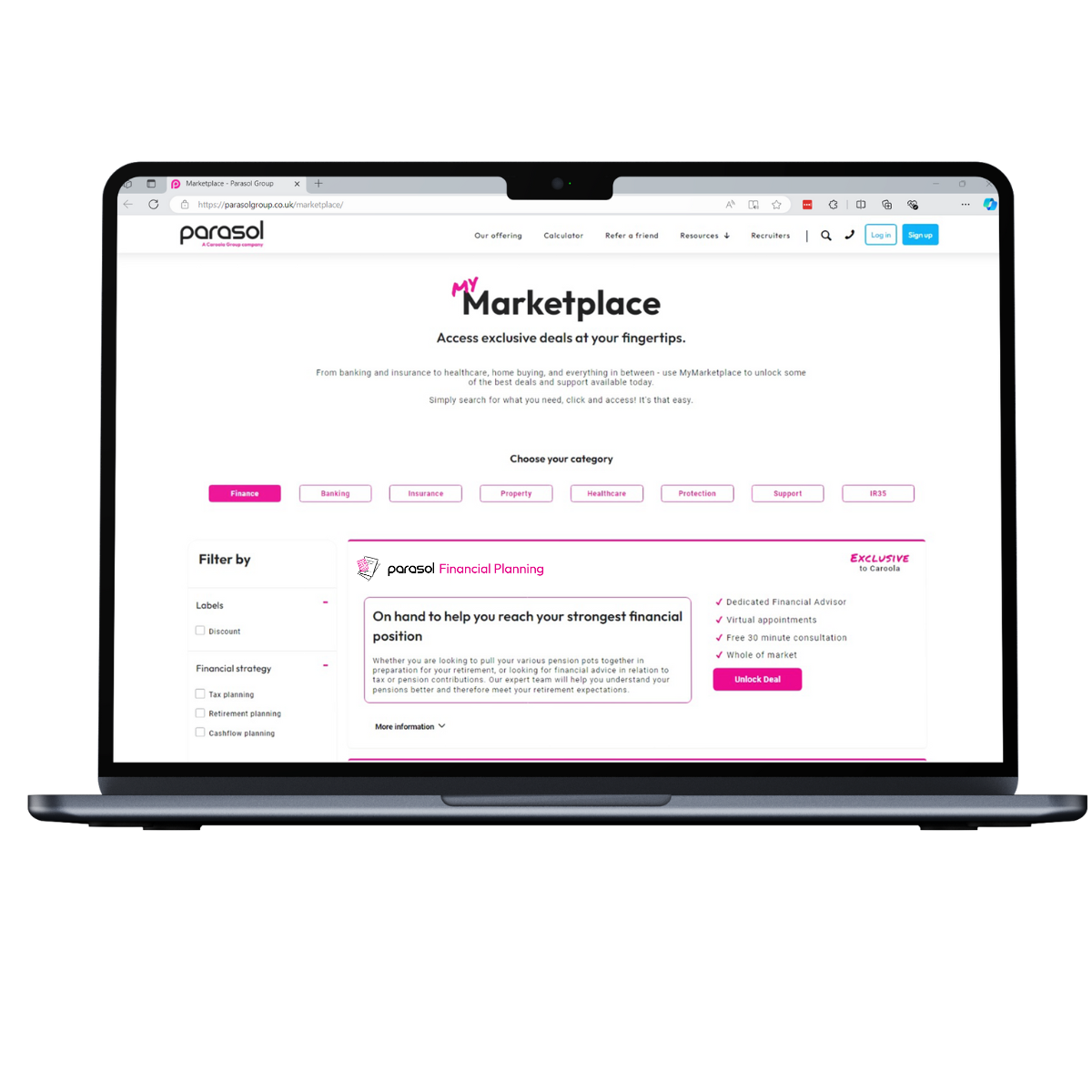

MYMarketplace

The best deals and support available to contractors today.

From finance and insurance to healthcare, home buying, and everything in between - use MyMarketplace to unlock the best deals and support on the market.

Why contractors choose Parasol

Compliant.

Secure.

Trusted.

Gold standard protection with Parasol. As a founding member of the FCSA, we put compliance at the heart of everything we do. Be safe in the knowledge your tax will be paid correctly and on time, keeping you on the right side of HMRC.

With Cyber Essentials PLUS, your data is protected by the best-in-class security safeguards. Developed and operated by the National Cyber Security Centre (NCSC), it is one of the best steps we can take to secure your data.

Want to know you’ll be given a top-tiered service? Don’t just take our word for it, take a look at our Trustpilot score. We have a 4.7* rating out of 5, with over 4,300 reviews (and counting!). You can trust that we'll give you great service.

Want to find out more?

Our team are ready to answer any questions you may have and provide a tailored, no-obligation quote. Simply get in touch through the form below or give us a call on 01925 645 265.

Calculate your

Calculate your